Site Moved

This site has moved to

http://goldenpivots.blogspot.com

Welcome. Note: Times posted here are now Eastern time.

Posted after Asia opening, 10:30 pm EST

Here are a set of silver charts for your perusal. A stock charts from Jimsioi at the bottom of the list.

Silver Weekly with the same trendlines applied

Silver Weekly with the same trendlines applied

NICE touch on the trend line.

NICE touch on the trend line.

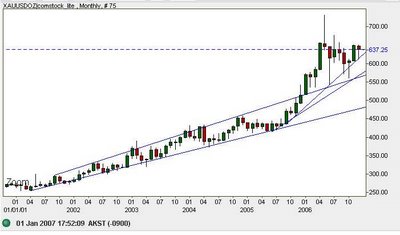

Here are a series of GOLD charts for your viewing pleasure. Note the time frames at the top as you review. I am calling this SMACK down OVER, BUY!! I hav been adding to positions throughout the past week, on today' reversal went long some MNG Calls on GG and more EGO dipping a bit into margin....

As is the case in the gold market... breakouts are fake outs...

Take a look at your gold stocks and I recommend ADDING.

Here are a weekly and daily on gold your viewing pleasure. My read is the A B C legs in mining stocks are complete and we are headed to D targets and beyond.

Gold continues higher this evening (it's 9:20 pm Alaska time and 1:20 am in New York. Looking at thist chart notice the horizontal line (current price) is testing the horizontal support/resistance area. We have also crossed the 50 unit moving average heading for the upper bollenger band. In shorter timeframes the price is very sensitive to the BBand. For traders this can be very useful.

Wecome again, for those of you in Rick's room I am inviting you to post up your hidden pivot studies here. I believe you can do it youself or just send me a chart with your studies. This is a space for all of us to use. It also provides somewhat of a record of our work

4 HOUR BAR - NOTICE THE REVERSAL OFF THE LOWER BBAND. I mentioned the low in GLD at 10am eastern today.

4 HOUR BAR - NOTICE THE REVERSAL OFF THE LOWER BBAND. I mentioned the low in GLD at 10am eastern today.

8 HOUR BAR, looking for a couple more zig zags and a nice H n S bottom, then off thru the trend-line with vigor... it'd be a nice outcome.

8 HOUR BAR, looking for a couple more zig zags and a nice H n S bottom, then off thru the trend-line with vigor... it'd be a nice outcome. PAAS - One of my favorite stocks. you can study these pivots yourself. Nice and accurate.

PAAS - One of my favorite stocks. you can study these pivots yourself. Nice and accurate.

Gold has several hidden pivots in the 636 area where we sit right now and price is having trouble moving through this conjestion area. On the 8 hour bar there's resistance at the 50 unit MA. Longer term hidden pivots project a move back to 724.5 or on the down side to 566.5

Here are a couple of charts illustrating the correction, or better put, "take down" of Gold. The first chart shows the trendline study and the second adds the BBands 50 unit with 50 unit on a 4 hour bar chart.

These Gold charts and price projections are based on www.netdania.com gold feed.

These Gold charts and price projections are based on www.netdania.com gold feed.